Landlord optimism is at its highest point for almost four years, according to the National Landlords Association (NLA), who recently published their Landlord Optimism Index.

| [relatedPosts title=”Related Posts”] |

|

|

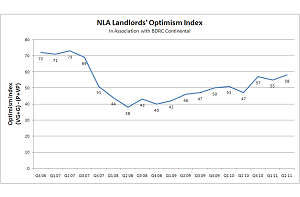

- Every quarter around 600 landlords from across the entire landlord market are asked: ‘How would you rate the prospects for your own letting business in the next three months?’

- The responses can be: Very Good (VG), Good (G), Fair (F), Poor (P) and Very Poor (VP).

- The percentages for each response are added together by sentiment, i.e. VG+G and P+VP.

- The resulting Index is calculated, thus: (VG+G) minus (P+VP).

- The Index began in Q4 2006 and is detailed in the ‘Feature Image’ (Click image to the right to enlarge):

Sixty-five per cent of landlords surveyed rated prospects for their own lettings business over the next three months as “very good” or “good”.

Landlords are also increasingly optimistic about the overall state of the private rented sector (PRS), with 54 per cent rating the industry’s prospects as “good or very good”, an increase of 8 per cent compared with the NLA’s findings during the second quarter of 2010.

However, landlords remain less certain about the state of the UK financial market with only 6 per cent rating this positively, a decrease of 3 per cent compared with the same time last year.

David Salusbury, NLA Chairman, commented:

“After a challenging few years, it is encouraging to hear that the majority of landlords are feeling positive about their lettings business and the overall state of the private-rented sector.

“The increasing availability of buy-to-let mortgages and strong demand for rental accommodation is further stimulating positive sentiments, with rent arrears appearing to stabilise and void periods decreasing in recent months.

“The private-rented sector is demonstrating its resilience, in marked contrast to some other industries and investments.

“Like other business people, it is clear that landlords are not immune from the effects of financial uncertainty. The fragile state of the economy is a concern for landlords, many of whom have mortgages to pay or rely on their property portfolios to earn a living.

“The cuts to local housing allowance are a further worry for tenants and landlords alike; both should be mindful of how they may be affected and give consideration to how they will deal with the long-term consequences of welfare reform.”