The latest research from BDRC Continental’s independent Landlords Panel survey reveals that more than one in four private landlords don’t owe anything on their rental properties.

|

| [relatedPosts title=”Related Posts”] |

|

|

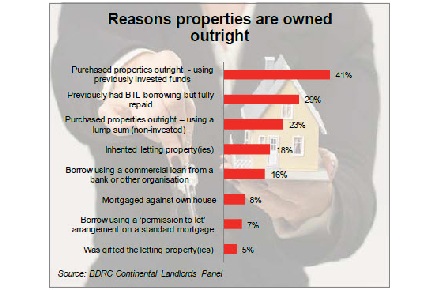

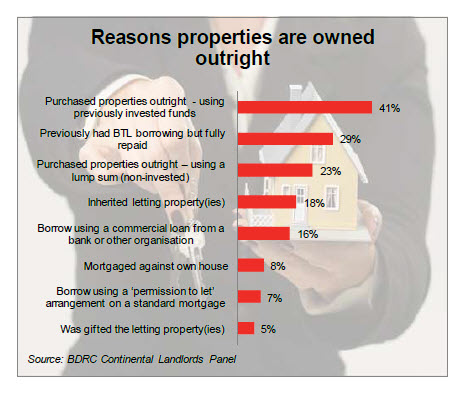

The quarterly Landlords Panel reveals that 28% of landlords own their letting portfolio outright, while 33% have a mixed portfolio, and 39% own their portfolio on one or more buy to let (BTL) mortgages. The average number of BTL loans held is 7.7.

It seems that in the current economic climate property is seen as a more profitable vehicle for savings than traditional investments. Of the 28% who own their portfolio outright 41% said they purchased their properties outright using previously invested funds, a further 23% purchased their properties outright using non-invested funds, while 29% have fully paid off past BTL borrowings.

This trend may explain why 37% of landlords say that they make a profitable full-time living from letting – although the proportions increase with the number of properties held. One in ten (11%) landlords with one property are able to make a profitable living from letting, compared to 38% of those with 5-10 properties, and 72% of those with 20+ properties.

However, for those who rely on BTL mortgages for some or all their portfolio, the story isn’t all a bed of roses. 39% agree that they see no real difference in the BTL products currently available, and 60% say that BTL lenders do not consider their individual circumstances as a landlord. It’s not surprising then that 74% agree that the BTL market needs greater innovation, and 89% agree that the BTL market would benefit from greater competition.

Commenting on the latest Landlords Panel findings Mark Long, Director for BDRC Continental, says: “According to our research it is clearly possible to make a full time, profitable living from private letting, and certainly those with larger property portfolios are more likely to be able to do so. BTL mortgage borrowing remains important for the majority of private landlords and our research suggests that there is still room in the market for providers to listen to their customers and provide a product suite better suited to their needs.”

Further Information

- This release contains a selection of findings from the Q1 2012 BDRC Continental/NLA Landlords Panel study. Fieldwork took place 9th – 26th March 2012 and incorporated 543 online interviews with National Landlords Association members.