Almost 12,000 homeowners rented out rooms to lodgers in January 20141 – the highest ever number recorded by SpareRoom.co.uk – as the post-Christmas financial pinch hits cash-strapped families.

|

| [relatedPosts title=”Related Posts”] |

|

|

The flat and house share site saw ads placed by new ‘live-in landlords’ rise by almost two thirds (63%) last month compared to January 2012 and by more than a third (34%) on January 2013.

Homeowners taking in lodgers on a Monday to Friday only basis have risen by more than half (56%) over the past two years, comparing data from January 2012 to January 2014.

Of the most densely populated UK cities, the biggest annual increase in people becoming live-in landlords was seen in Aberdeen (60%)2, where the property market has experienced growth almost unheard of outside of London: monthly room rents have risen by 11% from £446 to £494 in the past year alone. That means homeowners in Aberdeen can expect to earn £5,928 per year for letting a room.

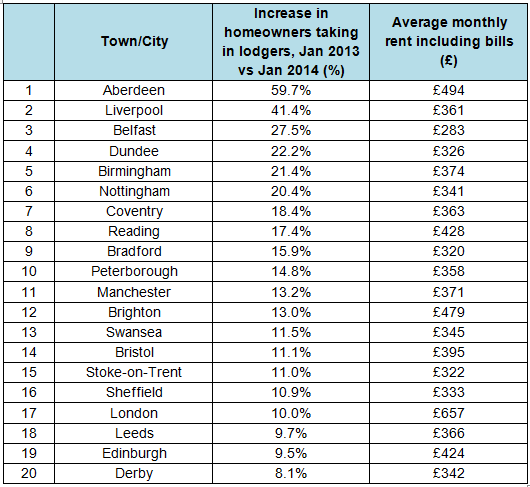

Meanwhile, Liverpool saw a 41% increase in homeowners taking in lodgers in the past 12 months, while Belfast saw lodger numbers up by more than quarter (28%). The table below shows the biggest UK cities with the highest growth in homeowners becoming live-in landlords:

Despite the increase in live-in landlords, SpareRoom saw a 20% surge in the number of people looking for rooms to rent across Britain when comparing demand in January 2013 with January 2014, but only a 0.5% increase in rooms available, showing that demand still greatly outweighs supply.

SpareRoom has launched Raise The Roof, a campaign – supported by housing charity Shelter – calling on the Government to raise the Rent A Room Scheme tax-free threshold to £7,500 per year immediately, and increase it year-on-year in line with inflation3.

The Rent A Room Scheme allows homeowners to earn tax-free income to a maximum of £4,250 per annum from letting furnished rooms to lodgers4. But that threshold – last revised in 1997, since which rents have risen by 103% – is now almost £1,350 below the average room rent in the UK, which stands at £5,593 per year, and a staggering £3,417 below the average London room rent. The campaign aims to encourage more homeowners to take in lodgers and ease the pressure on the hyper-competitive rental market.

Matt Hutchinson, director of Spareroom.co.uk, says: “It is not surprising the number of homeowners taking lodgers is at all-time high. Millions of families are looking for ways to combat the rising cost of living, while first time buyers are looking for ways to offset the costs of starting a home. Whether it’s to cover mortgage repayments, credit card debts or just to increase the overall household income, taking in a lodger can provide a much-needed financial boost.

“With increased pressure on the rental market, especially in London, homeowners hold the key to boosting supply, particularly in the short term. In England alone homeowners are sitting on an estimated 15 million empty bedrooms. Although there has been an increase in live-in landlords, the demand for rooms registered this January massively outweighed the supply. As rents skyrocket in many UK cities, and getting on the property ladder proves increasingly difficult, renters are looking for alternative forms of accommodation. The tax-free threshold offered to homeowners renting out furnished rooms needs to rise, and fast, if we are to boost supply.”

Further Information

- Total homeowner ads for lodgers posted in January 2014 was 11,542, compared to 8,628 in January 2013 and 7,083 in January 2012

- SpareRoom looked at data for the 40 largest cities in the UK (in terms of population), listed here are the top 20